Keep records as you complete or plan each activity, so you can monitor your progress and determine how you are doing. Facts, not guesswork or wishful thinking, are what you are after. You want facts, not fantasy, at your fingertips as you monitor your business plan.

- Track your income and cash flow. Knowing how much money you make is important, but knowing how much profit you make is even more important.

- Keep your business and personal records separate. It is your business you want to track, so make sure you keep separate business records. This should also include separate checking and/or bank accounts.

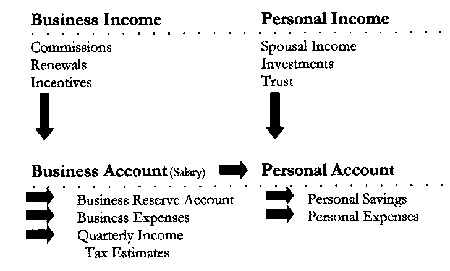

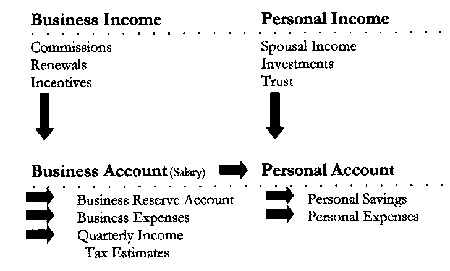

Use the Two-Account system for business and personal flow. Physically dividing insurance income between personal and business expenses can help you monitor distribution of income to ensure that both personal and business obligations will be met.

The Two-Account system works this way:

- Deposit all insurance income commissions, subsidies, and incentive payments into your business account. Spousal income, if any, should be deposited directly into the personal account, not your business account.

- Draw a regular (monthly, semimonthly, weekly) check from your business account to your personal account. The amount of the check should be adequate to meet your personal budget requirements.

- Pay all business expenses from the business account.

- Pay all personal expenses from the personal account.

- Although Social Security taxes will be withheld from income payments by the company, you will want to make quarterly estimated income tax payments from the business account.

The actual system of record keeping you use depends on many factors, not the least of which is whatever works best for you. However, here are some techniques you may find helpful:

- Once you develop a system for showing monthly profit and loss, compare it to your cash flow.

- Always know where you stand financially — whether it is good or bad news, it is a great motivator.

- Delegate as much of the bookkeeping as you can. If you do most of it yourself, do it during unproductive times like Sunday afternoons, when you're not selling.

The Sales Activity Manager™ Productivity Planner and/or eScoreBoard™ from Sales Activity Management, Inc. (SAM), can further support your record keeping requirements by providing a car mileage log, expense envelopes, and other supplements. Post these items on a daily basis for maximum ease. As an alternative, Chapter 4 of Chart Your Course for Success & Business Records (Form 1177) provides numerous pages to aid in tracking your business expenses.

Back to Top | Next

Ohio National is not affiliated with, nor does it endorse or sponsor, any particular prospecting, marketing or selling system.