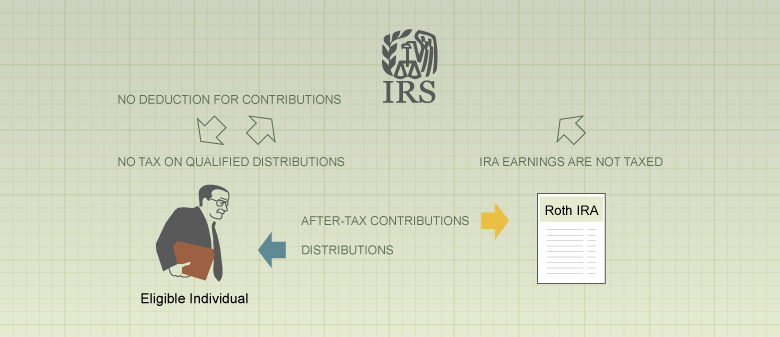

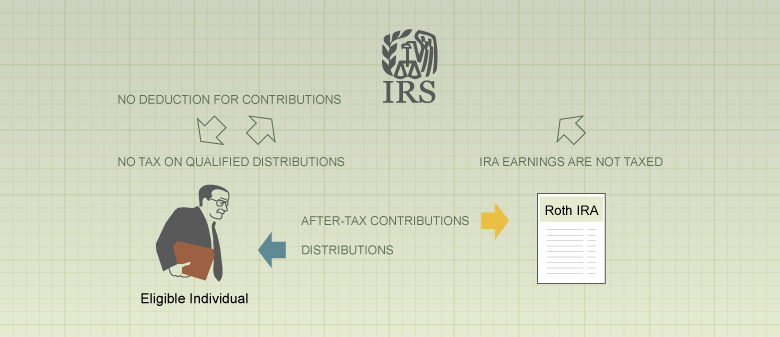

Eligible individuals (people with earned income, and adjusted gross incomes below specified amounts) can make nondeductible contributions to Roth IRAs up to a specified annual maximum.

After the owner has had a Roth IRA for at least five tax years, the earnings may be withdrawn federal income tax-free after the owner attains age 59½, dies, is disabled, or if the distribution is used for first time homebuyer expenses ($10,000 lifetime maximum).

![]() View or print a high-quality version of this graphic (requires Adobe Acrobat Reader).

View or print a high-quality version of this graphic (requires Adobe Acrobat Reader).

![]()

Copyright ![]() 2016, Pentera Group, Inc., 921 East 86th Street, Suite 100, Indianapolis, Indiana 46240. All rights reserved.

2016, Pentera Group, Inc., 921 East 86th Street, Suite 100, Indianapolis, Indiana 46240. All rights reserved.

This service is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that neither the publisher nor any of its licensees or their distributees intend to, or are engaged in, rendering legal, accounting, or tax advice. If legal or tax advice or other expert assistance is required, the services of a competent professional should be sought.

While the publisher has been diligent in attempting to provide accurate information, the accuracy of the information cannot be guaranteed. Laws and regulations change frequently, and are subject to differing legal interpretations. Accordingly, neither the publisher nor any of its licensees or their distributees shall be liable for any loss or damage caused, or alleged to have been caused, by the use of or reliance upon this service.